W-2C PDF Form for IRS

Sign Tax Digital eForm

Beschreibung von W-2C PDF Form for IRS: Sign Tax Digital eForm

PDFfiller has just released

.

It’s a web-based solution developed so you can complete,

. It contains this specific PDF document with fillable fields.

After opening the app, you may choose the most recent version of the income tax return from the dropdown list. Then click Fill Now and

.

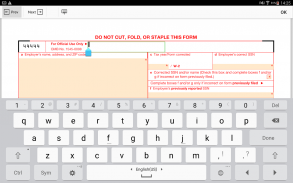

The interface is designed to be straightforward and user-friendly. But if you’re confused where to start from, we’ll help guide you through the process.

Tap on any field and then the right or left arrow on the upper panel - they will highlight in green the fields you need to fill out in their sequential order. If you’re still unsure how it works, click Help on the bottom of the screen. There will be a detailed guide explaining all of the features of the application.

on a desktop computer.

You can preview the pages and edit the document using the following tools:

✓ Add text on any part of the pages. Just tap whenever you’re ready and start typing. The text settings allow you to change the font and size. You also have the option to make the text bold, italic or underlined. The colors you can select are black, blue, red and white. If you didn’t like the result, you can tap the trash bin icon to delete it.

✓ Write or draw anything in your document using the Write feature. There is an option to resize the thickness of your tool and palette with a wide spectrum of colors. The drawing can be dragged to another place or deleted altogether.

✓ Cross, check or circle relevant information using the corresponding icons.

✓ Erase unnecessary text, blackout information you don’t want to reveal and highlight important sections.

✓ Attach a photo by downloading it from your device or taking a picture with your camera.

✓ Add a date to the document.

✓ Leave comments with the help of sticky notes.

✓ Draw arrows, lines and add text boxes to the fillable W-2C.

This Corrected Wage and Tax Statement consists of two pages and is divided into two parts: the data that you indicated in Form 2-WC that is marked as Previously reported in the left column; and the updated data marked as Correct information in the right column.

In principle, information your providing is the same as what you provided in your W-2. You have to provide a full report on the wages and compensations paid to your employees and taxes withheld from them.

And in this PDF form W-2C, you have the opportunity to correct the data that’s incorrect and e-file it to the Internal Revenue Service.